Confused about which Tax Regime to choose?

Old Regime with deductions and exemptions, or New Regime with lower slab rates, but fewer exemptions.

Don’t worry and keep reading till the end. this will help you decide which Regime will be beneficial and help you save the most taxes.

Why do you have to opt for a Tax Regime?

Central Board of Taxes (CBDT), Government of India made it COMPULSORY for employers to seek information from their employees on which regime they wish to opt for?

Based on the selection of the tax regime by the employees, the employer shall deduct TDS accordingly.

If a tax payer FAIL to choose between the New and Old Tax Regime, the employer will take the New Tax Regime as DEFAULT and Subtract the TDS (Tax deduction at source) under it at the time of salary credit each month. This could mean a Higher TDS!

However, you will have the option to Change it at the time of Filing your ITR.

New vs Old Regime Income Tax Slabs – How do they stack up?

| Particulars | Old Tax Regime | New Tax Regime |

| Basic Exemption Limit | Rs. 2.5 Lakhs | Rs. 3 Lakhs |

| Income Tax Rebate Limit | Rs. 5 Lakhs | Rs. 7 Lakhs |

| Standard Deduction | Rs. 50,000 | Rs. 50,000 |

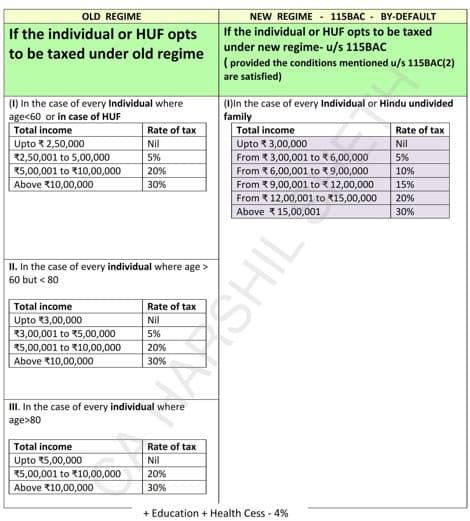

Income Tax Slab Rates

1. Old Regime Income Tax Slab Rates

| Income Range (Amount Rs.) | Tax % |

| 0 – 2.5 Lakhs | Nil |

| 2.5 – 5 Lakhs | 5% |

| 5 – 10 Lakhs | 20% |

| Above 10 Lakhs | 30% |

2. New Regime Income Tax Slab Rates

| Income Range (Amount Rs.) | Tax % |

| 0 – 3 Lakhs | Nil |

| 3 – 6 Lakhs | 5% |

| 6 – 9 Lakhs | 10% |

| 9 – 12 Lakhs | 15% |

| 12 – 15 Lakhs | 20% |

| Above 15 Lakhs | 30% |

The rate of tax in the case of old regime income tax and new regime income tax is excellently summarized below by CA Harshil Sheth

Deductions and Exemptions Available under old regime income tax and new regime income tax

1. Old Regime Income Tax

- Investments under Section 80C (PPF, ELSS, EPF, Life Insurance Premium, Home Loan Principal, etc).

- Home Loan Interest Payment

- Health Insurance Premiums

- Expenses on medical treatment, training or rehabilitation of a disabled dependent

- Treatment of self or dependent for specified disease

- Contribution to NPS

- Interest paid on Education Loan

- Donation to specified institutions

- Disability of self

- House Rent Allowance

- Leave Travel Allowance

- Leave Encashment

- Mobile and Internet Reimbursement, Food Coupons or Vouchers, Uniform Allowance, etc.

2. New Regime Income Tax

- Deduction towards Employer’s Contribution to NPS

- Expenses towards earnings from Family Pension upto 15,000

- Standard deduction of up to 30 percent of the annual value of the let-out property, in case of rental income from property

- Exemption on Voluntary Retirement 10(10C), Gratuity u/s 10(10) and Leave Encashment u/s 10(10AA)

- Deduction for additional employee cost

- Amount paid or deposited in the Agniveer Corpus Fund

- Also, Interest and maturity proceeds from schemes such as Public Provident Fund (PPF) and Sukanya Samriddhi account and Life Insurance Policies remain Tax-Exempt under the New Regime.

The above deductions and exemptions are brilliantly Captured by CAclub India

How to Choose the Right Tax Regime?

- If you have income upto Rs 7 lakhs – the New Tax Regime is better

- If you have No Tax savings and Deductions to avail – consider going for the New Tax Regime

- If you have just 80C Deduction of Rs 1.5 lakh – the New Tax Regime might be better

- If you can avail 80C Deduction and also have a Home Loan – consider the Old Tax Regime

- If you have an HRA Deduction to claim – the Old Tax Regime might be better

Understand which Tax Regime will be more beneficial for you depending on your Income level

- For Income upto Rs. 8 Lakhs

- If Deductions + Exemptions > Rs. 2,12,500 : Old Regime

- If Deductions + Exemptions < Rs. 2,12,500 : New Regime

- For Income upto Rs. 9 Lakhs

- If Deductions + Exemptions > Rs. 2,62,500 : Old Regime

- If Deductions + Exemptions < Rs. 2,62,500 : New Regime

- For Income upto Rs. 10 Lakhs

- If Deductions + Exemptions > Rs. 3,00,000 : Old Regime

- If Deductions + Exemptions < Rs. 3,00,000 : New Regime

- For Income upto Rs. 11 Lakhs

- If Deductions + Exemptions > Rs. 3,25,000 : Old Regime

- If Deductions + Exemptions < Rs. 3,25,000 : New Regime

- For Income upto Rs. 12 Lakhs

- If Deductions + Exemptions > 350,000 : Old Regime

- If Deductions + Exemptions < 350,000 : New Regime

- For Income upto Rs. 13 Lakhs

- If Deductions + Exemptions > Rs. 3,62,000 : Old Regime

- If Deductions + Exemptions < Rs. 3,62,000 : New Regime

- For Income upto Rs. 14 Lakhs

- If Deductions + Exemptions > Rs. 3,75,000 : Old Regime

- If Deductions + Exemptions < Rs. 3,75,000 : New Regime

- For Income upto Rs. 15 Lakhs

- If Deductions + Exemptions > Rs. 4,08,500 : Old Regime

- If Deductions + Exemptions < Rs. 4,08,500 : New Regime

- For Income of Rs. 15.5 lakhs – 5 crore

- If Deductions + Exemptions > Rs. 4,25,000 : Old Regime

- If Deductions + Exemptions < Rs. 4,25,000 : New Regime

Taxation review for Free. Get your Salary / Income reviewed for taxation by team of experts for absolutely free! Please mail your queries on askfincandy@gmail.com

If you liked this article, please share the information with other tax payers, HR Manager to circulate in the company, etc.

Author: @garimabajpai