The MoF has made a last-minute bold decision that has created waves of concern among both advisors and investors community.

The change in taxation on capital gains from debt mutual fund is seen as step to move away the tax arbitrage and create a level playing field for bank FD’s. While the government is trying to bring the uniformity across all asset classes and players, I believe that there was something else as well which caused them to make this move at the last minute.

What led the Ministry of Finance (MoF) to change the taxation of Debt MF?

I believe that this decision is also intended to enhance the liquidity position of banks and protect them from potential risks. It seems that the government is attempting to address a more significant issue through this action.

Key Points to Note – Reasons for change of taxation in debt mutual funds

1. The fear of contagion effect of failure of SVB and Signature Bank has alerted the RBI to check the sustainability of Indian Banks. Although such failures are unlikely in the Indian environment due to the stringent regulatory practices followed by RBI but as expected they are more conservative than US regulators when it comes to treasury operations.

2. Banks may have to step up mark to market provisioning on their bond portfolios which can have a significant impact on banks financial position. The MoF has asked banks to submit data about their held till maturity portfolio (HTM) and mark to market (MTM) losses in their trading books to identify any potential stress. The government doesn’t want to be caught off guard if the crisis spirals further.

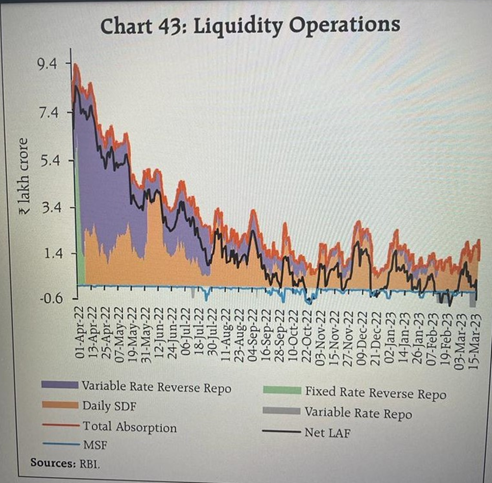

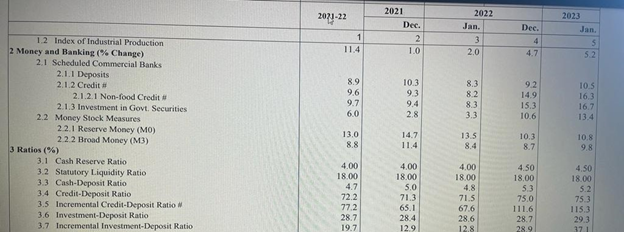

3. While demand for credit rises at the fastest rate, the bank deposit growth is comparatively slower due to which banks have turned cautious while lending to maintain the margins. If banks are unable to attract sufficient deposit to meet the credit demand, then they may have to borrow money which could increase their costs and reduce their margins. Lower deposit growth also makes it more difficult for banks to maintain sufficient liquidity.

4. RBI has been hiking rates taking cues from other major central banks to tame the runaway inflation. Each passing jump in the interest rate, while it’s trying to contain the inflation, it’s also hurting our economic growth. We are expecting RBI will consider another 25bps interest rate hike next month to keep inflation in its target zone which will further impact the bank liquidity negatively.

Conclusion

Hence the move by MoF to curb the tax arbitrage of debt mutual fund is a measure to address the liquidity issues of banks to some extent.

How would I manage my investment portfolio?

It’s always advisable to have a well-defined asset allocation strategy and review your portfolio to see if there are any changes required and act accordingly. Even though the indexation benefit is curbed, the debt mutual funds will remain popular due to other benefits such as convenience, flexibility and potential for capital appreciation in the falling interest rate environment.

Author: Preeti Grover

Visit Preeti Grover on Linkedin: https://www.linkedin.com/in/preeti-grover-67a9868b/